What We Do

First Lien Position

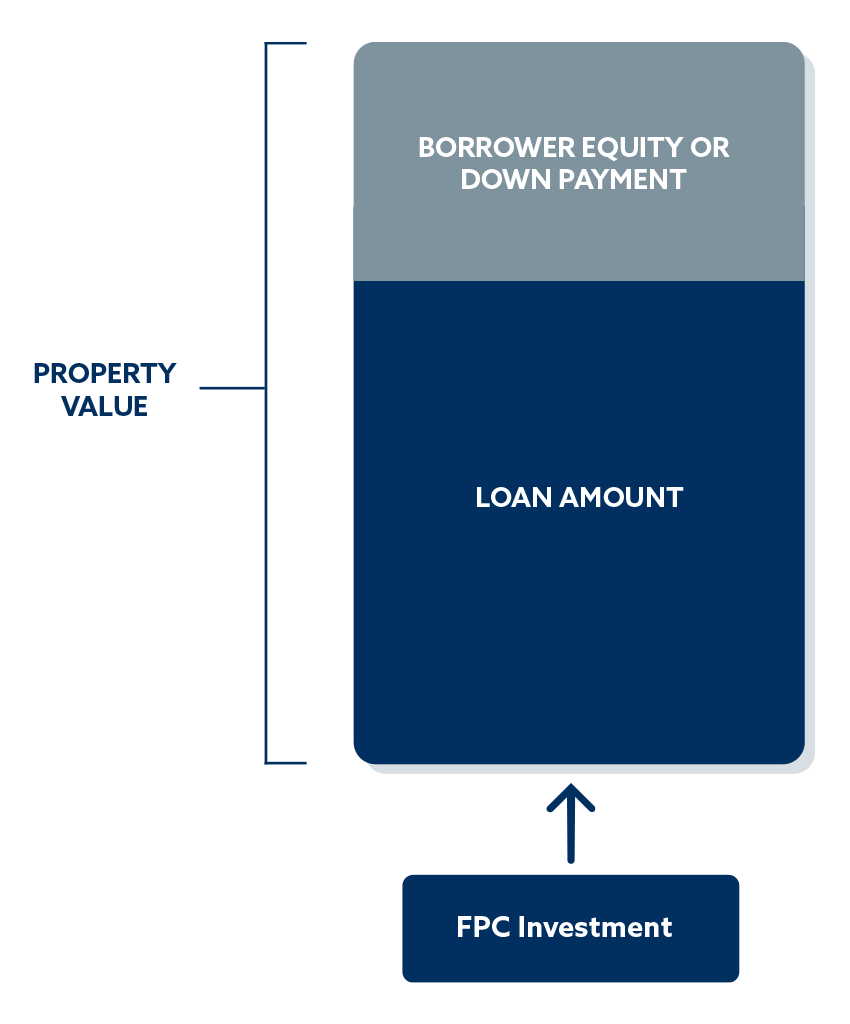

- Each loan is secured by a first lien deed of trust. This is a key component of our risk mitigation strategy. Senior loan positions provide additional protections that equity does not. In the case of default, we have many remedies as the senior lender. Among the options, the senior lender has the choice to own the property and liquidate it to preserve capital

Diversification

- FPC investments are intentionally diversified in many different aspects. The loan participations are limited in several ways to avoid concentration risk.

- Loans are diversified by property type, tenant, borrower, and geography.

Targeted Loan Profiles

- Property Types:

- Multifamily residential

- Multi-tenant retail

- 1-4 tenant credit tenant retail

- Industrial

- Loan Types: Acquisition, refinance, construction

- Loan Amount: $1MM to $5MM

- Loan to Value: 50%-75%

- Net Interest Rate: 7.0%-9.0%

- Transaction Fees: 1%-2% origination fees and 0.5%-1.5% exit fees

Unique and Exclusive

FPC has a unique and exclusive access to the investment pipeline. The originators (GMC) of the investments have a 40+ year track record as a private commercial real estate lender and the FPC management team has investor relations and investment management experience.